GSA SF 1444 2013-2024 free printable template

Show details

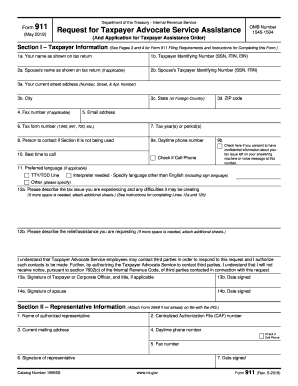

REQUEST FOR AUTHORIZATION OF ADDITIONAL CLASSIFICATION AND RECHECK APPROPRIATE BOX SERVICE CONTRACT CONSTRUCTION CONTRACT OMB Control Number: 90000066 Expiration Date: 4/30/2022Paperwork Reduction

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sf 1444 2013-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sf 1444 2013-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sf 1444 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit davis bacon wage classifications form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

GSA SF 1444 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sf 1444 2013-2024 form

01

Start by gathering all the necessary documents and information to fill out how to 1444. This may include personal identification details, financial information, and any relevant supporting documents.

02

Carefully read through the instructions and guidelines provided for filling out how to 1444. Make sure you understand the requirements and any specific instructions given.

03

Begin by providing your personal details, such as your name, address, and contact information, as required in the form.

04

Follow the prompts on the form to enter your financial information accurately. This may include details about your income, assets, debts, and any other relevant financial information.

05

Double-check all the information you have entered to ensure its accuracy and completeness. Mistakes or missing information may cause delays or complications in the processing of your application.

06

Once you are confident that all the required information has been provided accurately, review the form one final time before submitting it.

Who needs how to 1444?

01

Individuals who are applying for a specific program or service that requires the completion of how to 1444.

02

People who are seeking financial assistance, benefits, or other forms of support that necessitate the submission of this form.

03

Any individual who is instructed or required by an organization, institution, or government agency to fill out how to 1444 as part of a specific process or application.

Video instructions and help with filling out and completing sf 1444

Instructions and Help about standard form 1444 davis bacon

Fill 1444 form download : Try Risk Free

People Also Ask about sf 1444

How do you find the square root of 144 without a calculator?

What is a square root of 1444?

How do you solve root 1444?

What is the cube of root 1444?

How do you find the square root of 144?

What is √ 1444 in division method?

What is the simplest form of √ 144?

How do you find the roots of 144?

How do you manually find the square root of 144?

What is √ 1444 in division method?

IS 140 a perfect cube?

What's the square of 144?

How do you find the square root of a number manually?

How do you find the root in division method?

Is 1444 a perfect cube?

Is 43200 a perfect cube?

What is the square root of 144 by long division method?

How do you simplify the square root of 144?

Is 1444 a perfect square?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is how to 1444?

How to 1444 is a mathematical problem that does not have a single answer. The specific answer to the problem depends on the specific context in which it is asked.

Who is required to file how to 1444?

Individuals who had net self-employment income of $400 or more are required to file Form 1040 and Schedule SE, Self-Employment Tax.

How to fill out how to 1444?

This question does not make sense. It is unclear what you are asking and what "1444" is referring to. Please provide more information so that a more specific answer can be provided.

When is the deadline to file how to 1444 in 2023?

The deadline to file Form 1444 for the 2023 tax year has not yet been announced. It is generally due on April 15th of the following year.

What information must be reported on how to 1444?

Form 1444 is a document used to report the sale of securities or the change in beneficial ownership of securities by an insider of a publicly traded company. The information that typically needs to be reported on Form 1444 includes:

1. Name and contact information of the insider filing the form.

2. Relationship of the insider with the company (e.g., officer, director, principal stockholder).

3. Date of the transaction.

4. Description of the security being sold or transferred, including the type of security and the number of shares or units.

5. Nature of the transaction (e.g., sale, transfer, gift).

6. Date and price of the transaction.

7. Purpose of the transaction (e.g., personal investment, estate planning, diversification).

8. Source of securities (e.g., purchase, exercise of options, conversion of convertible securities).

9. Whether the transaction was reported in a previous Form 1444 filing.

10. Any additional relevant information or explanations that may be required.

It is important to note that the specific reporting requirements may vary depending on the jurisdiction and the regulations applicable to the company and the insider. It is advisable for insiders to consult with legal and compliance professionals to ensure proper filing and compliance with all relevant laws and regulations.

What is the penalty for the late filing of how to 1444?

Form 1444 is related to the Wage and Tax Statement (W-2) and reports wages, tips, and other forms of compensation paid to employees. There is no penalty specifically for the late filing of Form 1444. However, there are penalties associated with the late or incorrect filing of W-2 forms.

If an employer fails to file correct W-2 forms by the due date, they may be subject to penalties. The penalty rates depend on how late the forms are filed and the size of the employer. For example, as of 2021, if the W-2 forms are correctly filed no more than 30 days late, the penalty is $50 per form, with a maximum penalty of $556,500 for large businesses. If the forms are filed more than 30 days late, the penalty increases to $110 per form, with a maximum penalty of $1,669,500 for large businesses. These penalties are subject to change based on updates to tax laws and regulations.

How can I get sf 1444?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific davis bacon wage classifications form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the additional classification electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your standard form 1444.

How can I edit how to 1444 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing contact navy form.

Fill out your sf 1444 2013-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Classification is not the form you're looking for?Search for another form here.

Keywords relevant to 1444 form print

Related to submit petition

If you believe that this page should be taken down, please follow our DMCA take down process

here

.